Let’s be real — crypto trading isn’t easy. Sure, it looks flashy on TikTok and YouTube: charts flying, massive gains, lifestyle flexes. But once you step into the world of actual trading, it doesn’t take long to realize just how brutal it can be without the right mindset, tools, and strategy.

I’ve been in the crypto trenches long enough to know what separates gamblers from professionals. I’ve made the mistakes, taken the losses, and done the work — turning this from a side hustle into a full-time income stream. And if you’re serious about doing the same, you need to start by avoiding the landmines.

Here are the top 5 mistakes new crypto traders always make — and how to avoid them.

Table of Contents

1. Chasing Green Candles (FOMO Trading)

We’ve all done it. You see Bitcoin up 7% in an hour, or some obscure altcoin exploding, and your brain screams: “Get in before it’s too late!”

This is emotional trading at its worst.

The mistake: Buying pumps without a strategy — only to get dumped on by smarter money.

The fix: Use TradingView to zoom out and analyze structure, not just hype. Set alerts at logical support/resistance levels. When you trade with data, not emotion, you stop reacting and start executing.

👉 I’ve built my workflow using TradingView’s alerts, custom indicators, and chart layouts. It keeps me sharp and patient.

Try TradingView with my link — I use the Pro+ plan, but even the free version is powerful when you’re starting.

2. Ignoring Risk Management

It’s not exciting to talk about, but risk is everything. Most beginners blow up accounts not because of bad picks — but because they overexpose on one play and let emotions drive the rest.

The mistake: Going all-in or risking too much per trade.

The fix: Follow the 1–2% rule. Never risk more than 1–2% of your capital on a single trade. Use stop-losses and journal every outcome.

Personally, I keep a log of every trade I make — win or lose — including reasoning, size, and emotional state. You’ll be shocked how quickly your trading matures with just this one habit.

3. Using the Wrong Exchange

Not all crypto exchanges are created equal. Some have shady practices, wide spreads, high fees, or — worse — they go down when the market gets volatile (aka, when you need it most).

The mistake: Trading on unreliable or overhyped platforms.

The fix: Use an exchange that’s built for pros but still beginner-friendly.

For me, that’s Kraken.

It’s stable, fast, transparent, and has one of the most secure reputations in the industry. I’ve traded through multiple bull and bear markets — Kraken is the only exchange I trust with serious money. You can even chart your Kraken pairs directly inside TradingView, which streamlines the entire process.

🔗 Try Kraken here and earn $20 CAD after your first 30 days of trading:

https://krakenpro.onelink.me/9f1e/gzlppy7l

Use code: 5byw79yw

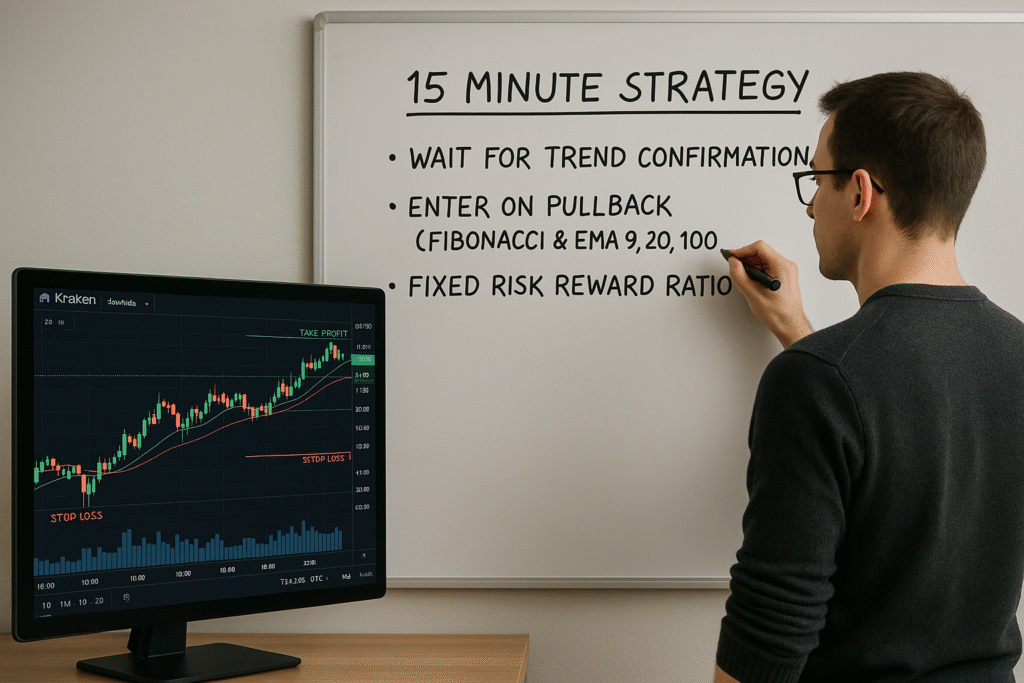

4. No Trading Plan or Strategy

Jumping into trades without a plan is like driving blindfolded and hoping you don’t hit a wall. Most beginners react to price, memes, or influencers instead of having a repeatable edge.

The mistake: Random entries and exits based on emotion, not structure.

The fix: Build a simple, tested strategy you can repeat. For example:

- Trade only on 1-hour and 4-hour timeframes

- Wait for clear trend confirmation

- Enter on pullbacks using Fibonacci or EMAs

- Set a fixed risk/reward ratio (e.g., 1:2 minimum)

Once I committed to this level of discipline, my profitability exploded — not because I was smarter, but because I became consistent.

Bonus tip: Use TradingView to backtest your setups. Their bar replay tool is next-level for refining your strategy in real time.

5. Overtrading (aka “Boredom Trades”)

Crypto markets never sleep — and that’s part of the trap. It’s easy to feel like you always need to be in a position to be “doing something.”

The mistake: Forcing trades when there’s no edge or setup, just to feel busy.

The fix: Learn to wait.

One of the hardest skills in trading is sitting on your hands. But the best traders? They strike with precision — not out of boredom.

I use alerts in TradingView to notify me only when the setup I’m waiting for is in play. That way, I’m not staring at charts all day or burning out on noise. Trading less = winning more.

Final Thoughts: Mastering the Game Long-Term

Crypto trading isn’t just about being right — it’s about being prepared. With the right tools, mindset, and routine, you can turn trading from a gamble into a sustainable, scalable income stream. I did — and you can too.

The two tools that helped me make that shift:

- ✅ TradingView — for strategy, alerts, and high-performance charting

- ✅ Kraken — for secure, pro-grade execution and tracking

If you’re just starting, focus on the basics:

- Avoid emotional decisions

- Use reliable platforms

- Learn from every trade

- Stick to your strategy

It’s not about being perfect — it’s about being consistent.

🚀 Ready to take your trading seriously?

Start using TradingView here:

👉 https://www.tradingview.com/pricing/?share_your_love=ShawnBurgundy

And when you’re ready to trade with confidence, claim your $20 CAD on Kraken with this link:

👉 https://krakenpro.onelink.me/9f1e/gzlppy7l

Referral Code: 5byw79yw

Let’s trade smarter — not harder. Your portfolio will thank you.